All Categories

Featured

Table of Contents

- – What is the process for withdrawing from an Li...

- – How can an Immediate Annuities help me with es...

- – What are the top Annuity Contracts providers ...

- – What does an Flexible Premium Annuities include?

- – How can an Annuities For Retirement Planning...

- – What are the tax implications of an Flexible...

Keep in mind, nevertheless, that this doesn't state anything concerning readjusting for rising cost of living. On the plus side, even if you assume your alternative would be to spend in the stock exchange for those seven years, which you 'd get a 10 percent yearly return (which is much from certain, particularly in the coming decade), this $8208 a year would be greater than 4 percent of the resulting nominal supply value.

Example of a single-premium deferred annuity (with a 25-year deferment), with four payment options. Politeness Charles Schwab. The regular monthly payment right here is highest for the "joint-life-only" option, at $1258 (164 percent more than with the prompt annuity). Nonetheless, the "joint-life-with-cash-refund" choice pays out just $7/month much less, and warranties at the very least $100,000 will certainly be paid out.

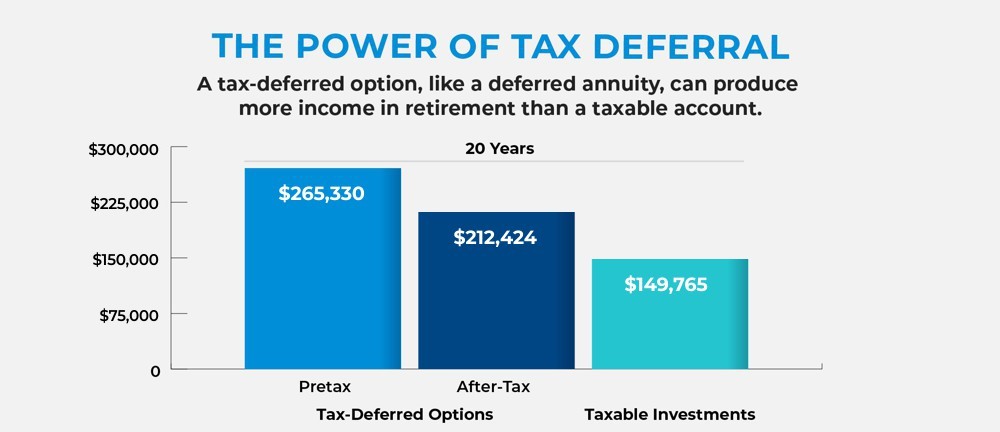

The way you purchase the annuity will certainly figure out the response to that inquiry. If you get an annuity with pre-tax bucks, your premium minimizes your taxed income for that year. According to , getting an annuity inside a Roth strategy results in tax-free settlements.

What is the process for withdrawing from an Lifetime Income Annuities?

The consultant's primary step was to establish a thorough monetary strategy for you, and after that describe (a) just how the recommended annuity suits your general strategy, (b) what options s/he taken into consideration, and (c) how such alternatives would certainly or would certainly not have actually caused lower or greater payment for the expert, and (d) why the annuity is the remarkable selection for you. - Annuities for retirement planning

Of training course, an advisor may try pushing annuities even if they're not the very best fit for your situation and objectives. The factor can be as benign as it is the only product they offer, so they drop prey to the typical, "If all you have in your toolbox is a hammer, rather soon whatever begins appearing like a nail." While the expert in this scenario may not be dishonest, it boosts the threat that an annuity is an inadequate option for you.

How can an Immediate Annuities help me with estate planning?

Since annuities frequently pay the representative offering them much higher compensations than what s/he would receive for investing your money in mutual funds - Annuity accumulation phase, allow alone the no payments s/he 'd get if you buy no-load common funds, there is a large incentive for agents to push annuities, and the a lot more challenging the better ()

An unscrupulous advisor recommends rolling that quantity into brand-new "far better" funds that simply take place to bring a 4 percent sales load. Accept this, and the advisor pockets $20,000 of your $500,000, and the funds aren't likely to carry out far better (unless you chose even a lot more badly to begin with). In the exact same instance, the expert can guide you to get a complicated annuity keeping that $500,000, one that pays him or her an 8 percent compensation.

The expert hasn't figured out how annuity repayments will certainly be exhausted. The consultant hasn't revealed his/her compensation and/or the charges you'll be charged and/or hasn't revealed you the effect of those on your eventual settlements, and/or the compensation and/or fees are unacceptably high.

Present interest rates, and thus predicted payments, are traditionally low. Even if an annuity is ideal for you, do your due diligence in comparing annuities sold by brokers vs. no-load ones marketed by the issuing company.

What are the top Annuity Contracts providers in my area?

The stream of month-to-month repayments from Social Protection resembles those of a deferred annuity. As a matter of fact, a 2017 comparative evaluation made a thorough comparison. The complying with are a few of the most prominent points. Considering that annuities are voluntary, the individuals getting them usually self-select as having a longer-than-average life span.

Social Security advantages are completely indexed to the CPI, while annuities either have no inflation security or at a lot of provide an established percentage yearly rise that may or may not make up for rising cost of living in full. This kind of motorcyclist, as with anything else that boosts the insurer's threat, needs you to pay even more for the annuity, or approve lower payments.

What does an Flexible Premium Annuities include?

Please note: This post is meant for educational functions only, and ought to not be thought about economic recommendations. You need to get in touch with an economic professional before making any significant financial choices. My career has had numerous unforeseeable weave. A MSc in academic physics, PhD in experimental high-energy physics, postdoc in fragment detector R&D, research setting in speculative cosmic-ray physics (including a pair of check outs to Antarctica), a brief job at a tiny engineering services firm supporting NASA, followed by starting my very own small consulting practice sustaining NASA jobs and programs.

Since annuities are intended for retirement, tax obligations and charges might use. Principal Security of Fixed Annuities.

Immediate annuities. Used by those that desire trusted revenue quickly (or within one year of acquisition). With it, you can tailor income to fit your demands and create revenue that lasts permanently. Deferred annuities: For those who intend to grow their cash in time, yet are eager to postpone accessibility to the money till retirement years.

How can an Annuities For Retirement Planning help me with estate planning?

Variable annuities: Offers greater possibility for growth by investing your cash in financial investment alternatives you choose and the ability to rebalance your portfolio based on your preferences and in a means that aligns with altering monetary objectives. With taken care of annuities, the company spends the funds and provides a rates of interest to the customer.

When a fatality case occurs with an annuity, it is essential to have a called recipient in the agreement. Various alternatives exist for annuity fatality benefits, depending on the contract and insurance firm. Selecting a reimbursement or "duration certain" choice in your annuity provides a fatality benefit if you die early.

What are the tax implications of an Flexible Premium Annuities?

Calling a recipient aside from the estate can assist this process go extra efficiently, and can aid make sure that the profits go to whoever the specific desired the cash to head to instead than going with probate. When present, a survivor benefit is instantly included with your agreement. Depending on the kind of annuity you acquire, you might be able to add boosted survivor benefit and functions, but there might be extra expenses or charges linked with these add-ons.

Table of Contents

- – What is the process for withdrawing from an Li...

- – How can an Immediate Annuities help me with es...

- – What are the top Annuity Contracts providers ...

- – What does an Flexible Premium Annuities include?

- – How can an Annuities For Retirement Planning...

- – What are the tax implications of an Flexible...

Latest Posts

Decoding How Investment Plans Work Everything You Need to Know About Financial Strategies Defining Annuities Variable Vs Fixed Advantages and Disadvantages of Variable Annuity Vs Fixed Indexed Annuity

Exploring Immediate Fixed Annuity Vs Variable Annuity Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Advantages and Disadvantages of Fixed Vs Variable Ann

Breaking Down Your Investment Choices Everything You Need to Know About Fixed Vs Variable Annuities What Is the Best Retirement Option? Benefits of Choosing Between Fixed Annuity And Variable Annuity

More

Latest Posts